- Joined

- Sep 12, 2023

- Messages

- 2,506

- Location

- North Ridgeville, OH

- Cars in Garage

- 2

- Vehicle Details

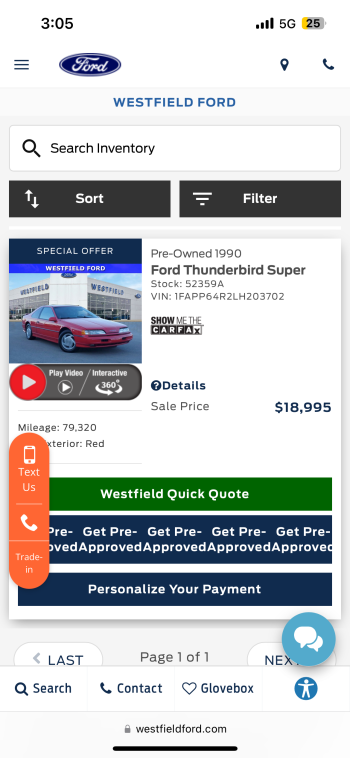

- 1997 Thunderbird 4.6, 1998 Mark VIII LSC

Here in OH you pay sales tax on the car at the county rate - between 6.5 and 8%, depending on the county.

Registration is about $45/yr for traditional ICE vehicles, but the state imposes an extra $100/yr fee on hybrids and another $100 on top of that ($200/yr) for PHEVs and EVs to help recoup lost gas tax revenue. A large portion of the road projects are paid for out of state funds; when gas prices were cheap the voters passed an increase of the base tax rate to 38.5 cents/gallon (on top of the federal tax). There are road projects all over the place - resurfacing is the norm but there have been a lot of re-decking or replacement of bridges that were built 70+ years ago.

Registration is about $45/yr for traditional ICE vehicles, but the state imposes an extra $100/yr fee on hybrids and another $100 on top of that ($200/yr) for PHEVs and EVs to help recoup lost gas tax revenue. A large portion of the road projects are paid for out of state funds; when gas prices were cheap the voters passed an increase of the base tax rate to 38.5 cents/gallon (on top of the federal tax). There are road projects all over the place - resurfacing is the norm but there have been a lot of re-decking or replacement of bridges that were built 70+ years ago.