- Joined

- Sep 22, 2023

- Messages

- 1,675

- Location

- Tennessee

- Vehicle Details

- Chameleon 1995 Thunderbird LX 4.6

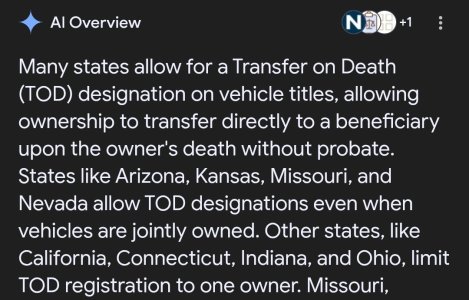

It depends on the state. Tennessee allows you to title a vehicle as "John Doe OR Jane Doe". The "OR" means that either person can sell or re-title the car without the other one's signature, alive or otherwise. When my FIL died, my MIL didn't have to do anything to her cars since they were listed as "OR" co-owners.Is that a Missouri thing? Interesting. I didn't know about the need to re-title vehicles for a TOD.

It also allows you to remain as the original owner and not have to re-title or present a death certificate when your spouse dies. A trust can be the second half of the "OR" equation, however its not shielded from litigation or probate if your name is still on it even with the "OR".

They also allow you to title it as "John Doe AND Jane Doe". The "AND" obviously means both parties have to sign off.