You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Finance Thread - What stocks are you in, etc.

- Thread starter gunn

- Start date

- Joined

- Sep 12, 2023

- Messages

- 3,139

- Location

- Charlotte, NC

- Cars in Garage

- 1

- Vehicle Details

- '95 Thunderbird with '18 TF 5.3L - SVO Engine

Holy fuck. I don't even want to talk about it.

Hold tight. The market is taking a breather. The drop is across the board. Look for lower entry points to average down your positions.

I'll be happy to take a look at your portfolio if you want to PM me we can discuss positions and options in private if you're interested.

I've got my losers too, it's not all cake and Ice cream.

dDUBb

PostWhore

Hold tight. The market is taking a breather. The drop is across the board. Look for lower entry points to average down your positions.

I hope it's having a breather after taking a huge shit for the whole past week.

I'm still good; haven't dropped to my buy in points for the most part - it was just all that unrealized gain went from 130% to 60% ..

Generalee0527

4th Gear Poster

- Joined

- Jan 4, 2024

- Messages

- 273

- Location

- SW GA

- Vehicle Details

- 97 Tbird, pbr front brakes, Sport edition 4.6 w/ 369k total miles by me the one and only owner.

I wish I knew how to trade. I got let go back in March 2000 and stuck my 10K in an IRA as a tax avoidance and that lying POS at Raymond James put me in 3-4 mutual funds that had a good record. in a year i had $2500 and I said F it and split it into GE & Ford. GE never recovered and I sold in 2015 for half what I paid. Ford went up to 15 so I took my $ and haven't been back Guess not having a teacher makes a difference. My new boss started talking about covered options or something like that and I just don't have much stomach nor time to follow stuff. Hell i have worked my butt off to raise 3 kids who are now in BIG school so I guess I can someday take a vacation. I just can't play rigged games like lottery.

- Joined

- Sep 12, 2023

- Messages

- 3,139

- Location

- Charlotte, NC

- Cars in Garage

- 1

- Vehicle Details

- '95 Thunderbird with '18 TF 5.3L - SVO Engine

I hear ya. It’s so important to do your own investing. My Dad got cleaned out like that by Merrill Lynch. They put his money in funds with 6 and 7% front loads and then churned them into other funds with 6 and 7% front loads about a year later. I was so pissed when I discovered what they had done but there was nothing I could do because mom & dad hired them as their “advisers”.I wish I knew how to trade. I got let go back in March 2000 and stuck my 10K in an IRA as a tax avoidance and that lying POS at Raymond James put me in 3-4 mutual funds that had a good record. in a year i had $2500 and I said F it and split it into GE & Ford. GE never recovered and I sold in 2015 for half what I paid. Ford went up to 15 so I took my $ and haven't been back Guess not having a teacher makes a difference. My new boss started talking about covered options or something like that and I just don't have much stomach nor time to follow stuff. Hell i have worked my butt off to raise 3 kids who are now in BIG school so I guess I can someday take a vacation. I just can't play rigged games like lottery.

- Joined

- Sep 12, 2023

- Messages

- 3,139

- Location

- Charlotte, NC

- Cars in Garage

- 1

- Vehicle Details

- '95 Thunderbird with '18 TF 5.3L - SVO Engine

- Joined

- Sep 12, 2023

- Messages

- 3,139

- Location

- Charlotte, NC

- Cars in Garage

- 1

- Vehicle Details

- '95 Thunderbird with '18 TF 5.3L - SVO Engine

I bought some PLTR Today at 24.10

- Joined

- Sep 12, 2023

- Messages

- 3,139

- Location

- Charlotte, NC

- Cars in Garage

- 1

- Vehicle Details

- '95 Thunderbird with '18 TF 5.3L - SVO Engine

Oh yeah, I’m down a lot too this week. Until I sell it’s just a number on a piece of paper. Consider it a buying opportunity on your winners to add to your position.I lost a shit ton of money today.

dDUBb

PostWhore

Oh yeah, I’m down a lot too this week. Until I sell it’s just a number on a piece of paper. Consider it a buying opportunity on your winners to add to your position.

This whole month. Sounds like a great buying opportunity - except I already cleared out all of my free cash from mutual funds

The thing that irritates me about the fed rate cut is that a lot of big tech companies have announced these mass layoffs .. Intel for example, to improve their bottom line .. 15k employees - stuff like that will reflect on the unemployment numbers the feds use to determine the "state of the economy" ..

- Joined

- Sep 12, 2023

- Messages

- 3,139

- Location

- Charlotte, NC

- Cars in Garage

- 1

- Vehicle Details

- '95 Thunderbird with '18 TF 5.3L - SVO Engine

Intel has issues unrelated to the Fed. Yes. Great buying opportunities. I’ll be doing some research this weekend looking for entry points.This whole month. Sounds like a great buying opportunity - except I already cleared out all of my free cash from mutual fundswent from a solid 5% APY to ( -20% ) so far.

The thing that irritates me about the fed rate cut is that a lot of big tech companies have announced these mass layoffs .. Intel for example, to improve their bottom line .. 15k employees - stuff like that will reflect on the unemployment numbers the feds use to determine the "state of the economy" ..

Sasha Y. did a great commentary on the situation. This guy’s great. His delivery style reminds me of Jeremy Clarkson.

dDUBb

PostWhore

I'll be happy to take a look at your portfolio

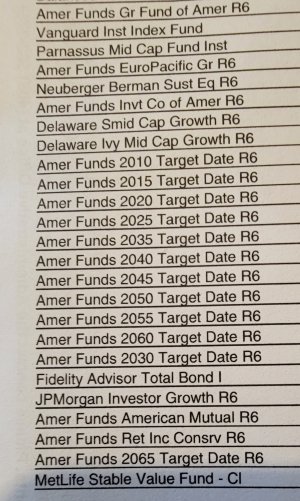

My 401k is currently equally distributed between all of these funds. I have been contributing somewhere between $20-25k on a yearly basis - but I can shift my portfolio around to go heavier on any of these funds at any time ..

My personal invesement portfolio with Schwab is another matter ( composed entirely of stocks ) .. I started this one in 2017, throwing extra money, about $300 a week, for the Chevy SS fund to help cover monthly payment, accessories, tires, weekends at the track, supercharger, etc .. but as of now, I've already paid off the car and finished my desired build - so that extra money was throw at stock purchases .. my original goal after the SS was paid off was to start saving to put a nice down payment on a C8 Corvette. I'm just not as enthusiastic about making this purchase now as I was in 2020 with insane dealership markups and these high interest rates on a new loan.

- Joined

- Sep 12, 2023

- Messages

- 3,139

- Location

- Charlotte, NC

- Cars in Garage

- 1

- Vehicle Details

- '95 Thunderbird with '18 TF 5.3L - SVO Engine

You're in All of those funds !? Holy Crap!

That's crazy. Personally I'm not a fan of funds at all. Funds follow indexes and you can do that on your own. But, if those are your only choices in that account then pick and stick with only one or two of the funds. Are those funds your only choices in that account? Is there a self-directed-brokerage option?

Those target date funds are the worst. Their returns suck and their fees are high. Have you looked at the fund fees on all of those funds? I bet you're paying a fortune in fund fees to maintain that list.

If you want to, PM me the details of your Schwab account and I'll be happy to review it for you. Don't post it publicly. Roughly $300 a week is a fantastic savings rate!

Yes, Definitely don't spend it on a car! Let that money grow towards your retirement. Vehicles are one of the worst investments next to say, lottery tickets. Just don't go there!

That's crazy. Personally I'm not a fan of funds at all. Funds follow indexes and you can do that on your own. But, if those are your only choices in that account then pick and stick with only one or two of the funds. Are those funds your only choices in that account? Is there a self-directed-brokerage option?

Those target date funds are the worst. Their returns suck and their fees are high. Have you looked at the fund fees on all of those funds? I bet you're paying a fortune in fund fees to maintain that list.

If you want to, PM me the details of your Schwab account and I'll be happy to review it for you. Don't post it publicly. Roughly $300 a week is a fantastic savings rate!

Yes, Definitely don't spend it on a car! Let that money grow towards your retirement. Vehicles are one of the worst investments next to say, lottery tickets. Just don't go there!

dDUBb

PostWhore

Is there a self-directed-brokerage option?

Yes, I just need to sign a waiver to self direct funds.

Have you looked at the fund fees on all of those funds?

It's managed by a 3rd party; the funds are consolidated into one account called the Balanced Pool .. my admin fees come out to $240 / yr.

Vehicles are one of the worst investments next to say, lottery tickets.

Wife wants me to buy her a new Tahoe or Suburban ..

Lottery tickets are like the stock market; can't win if you don't play. I hit 6 out of 7 numbers on the Super Lotto a few years back; if the digits were reversed on my 7th, I would have hit $1.2 million .. instead of the $1200 I recieved.

I'll see if I can snap a shot from one of my personal statements .. so you can laugh.

- Joined

- Sep 12, 2023

- Messages

- 3,139

- Location

- Charlotte, NC

- Cars in Garage

- 1

- Vehicle Details

- '95 Thunderbird with '18 TF 5.3L - SVO Engine

Awesome! It's great that your SS has retained it's value. That's not common. But the SS you have is a really desirable car. That's why.

Admin fees and fund fees are billed separately. Admin fees are withdrawn on the front end, the fund fees are withdrawn from your holdings within the fund on the back end (they skim it off the top) You're paying a lot more than $240/yr. You just don't see it. I'd look closely at the fees for each of those funds.

True, you can't win if you don't play. But play smart! The odds on stocks are way better than the odds on lottery tickets.

Admin fees and fund fees are billed separately. Admin fees are withdrawn on the front end, the fund fees are withdrawn from your holdings within the fund on the back end (they skim it off the top) You're paying a lot more than $240/yr. You just don't see it. I'd look closely at the fees for each of those funds.

True, you can't win if you don't play. But play smart! The odds on stocks are way better than the odds on lottery tickets.

- Joined

- Sep 12, 2023

- Messages

- 3,139

- Location

- Charlotte, NC

- Cars in Garage

- 1

- Vehicle Details

- '95 Thunderbird with '18 TF 5.3L - SVO Engine

PLTR reversed on an earnings beat (UP ~ 14 to 16% after hours). A ray of sunshine among the chaos on the street right now.

- Joined

- Sep 12, 2023

- Messages

- 3,139

- Location

- Charlotte, NC

- Cars in Garage

- 1

- Vehicle Details

- '95 Thunderbird with '18 TF 5.3L - SVO Engine

- Joined

- Sep 12, 2023

- Messages

- 3,139

- Location

- Charlotte, NC

- Cars in Garage

- 1

- Vehicle Details

- '95 Thunderbird with '18 TF 5.3L - SVO Engine

CDsDontBurn

PostWhore

Thoughts on JEPI, JEPQ, SCHH, SCHD, and / or RYLD anyone?

I'm trying to decide on buying one of these or double down on either F or T.

I have enough in dividend returns sitting in my brokerage account to buy a desired amount of one of those stocks.

I'm trying to decide on buying one of these or double down on either F or T.

I have enough in dividend returns sitting in my brokerage account to buy a desired amount of one of those stocks.

- Joined

- Sep 12, 2023

- Messages

- 3,139

- Location

- Charlotte, NC

- Cars in Garage

- 1

- Vehicle Details

- '95 Thunderbird with '18 TF 5.3L - SVO Engine

Not a fan of ETF's. In Brief:

JEPI - Currently has a hold rating. Currently 59.15 I'd look for a buy around $57

JEPQ - Currently has a buy rating but is up 16.45% YTD.

SCHH - Has a Hold Rating and is already up 30.79% YTD. Currently 22.60 I'd look for a buy in around $21

SCHD - Near an all time high at $84.65 and up 21.89% YTD. I wouldn't buy here. Look for a buy in around $78.83 It does have a Strong Buy/Buy rating though.

RYLD - Has a Strong Sell / Sell rating. Has fallen significantly since November of 2021. Down 2.7% YTD. Currently $16.14 Set an all time low of $14.75 back on August 5th.

T has finally dug itself out of the hole it was in forever. The time to buy was when it was down around 13 to 15 between July and October of last year. It's currently at almost $22. It's recent low was around $16 back in April. If you want it I'd wait for it to fall back below $20.

F has been a shit show. Currently down 11.8% YTD and has a Hold rating. Technicals indicate SELL. Seems to have a floor of support between $9.50 and $9.60.

Disclaimer: These are my opinions. I'm an idiot. Don't do what I do.

JEPI - Currently has a hold rating. Currently 59.15 I'd look for a buy around $57

JEPQ - Currently has a buy rating but is up 16.45% YTD.

SCHH - Has a Hold Rating and is already up 30.79% YTD. Currently 22.60 I'd look for a buy in around $21

SCHD - Near an all time high at $84.65 and up 21.89% YTD. I wouldn't buy here. Look for a buy in around $78.83 It does have a Strong Buy/Buy rating though.

RYLD - Has a Strong Sell / Sell rating. Has fallen significantly since November of 2021. Down 2.7% YTD. Currently $16.14 Set an all time low of $14.75 back on August 5th.

T has finally dug itself out of the hole it was in forever. The time to buy was when it was down around 13 to 15 between July and October of last year. It's currently at almost $22. It's recent low was around $16 back in April. If you want it I'd wait for it to fall back below $20.

F has been a shit show. Currently down 11.8% YTD and has a Hold rating. Technicals indicate SELL. Seems to have a floor of support between $9.50 and $9.60.

Disclaimer: These are my opinions. I'm an idiot. Don't do what I do.

CDsDontBurn

PostWhore

Not a fan of ETF's. In Brief:

JEPI - Currently has a hold rating. Currently 59.15 I'd look for a buy around $57

JEPQ - Currently has a buy rating but is up 16.45% YTD.

SCHH - Has a Hold Rating and is already up 30.79% YTD. Currently 22.60 I'd look for a buy in around $21

SCHD - Near an all time high at $84.65 and up 21.89% YTD. I wouldn't buy here. Look for a buy in around $78.83 It does have a Strong Buy/Buy rating though.

RYLD - Has a Strong Sell / Sell rating. Has fallen significantly since November of 2021. Down 2.7% YTD. Currently $16.14 Set an all time low of $14.75 back on August 5th.

T has finally dug itself out of the hole it was in forever. The time to buy was when it was down around 13 to 15 between July and October of last year. It's currently at almost $22. It's recent low was around $16 back in April. If you want it I'd wait for it to fall back below $20.

F has been a shit show. Currently down 11.8% YTD and has a Hold rating. Technicals indicate SELL. Seems to have a floor of support between $9.50 and $9.60.

Disclaimer: These are my opinions. I'm an idiot. Don't do what I do.

Thanks for your input Ron!

And while I acknowledge that you're not an expert and these are just your opinions, I feel your opinions are pretty good! I guess now I just have to decide what to buy.

Between all the above after your input, I have narrowed it down to SCHH, F, and T.

SCHH: Allows me to get back into REITs and with federal interest rates recently going down and expected to go further down by EOY, I would expect this to tick up some more.

F: My dollar cost average is $7.50-ish (without logging into my account, I know it's in this range). It would bring up my DCA if buying more, but I like it's dividend return.

T: I should have bought more when it was at it's lows, but I wasn't in a position to buy at the time. With it's current share price where it's at, I've just about broken even right now. I'm just in it for the divvy's.

RYLD: It's not on my list after your opinions input, but if I were to buy more, it'd just be a yield trap for me. But it's low price right now is really enticing. -_-

Decisions, decisions.

- Joined

- Sep 12, 2023

- Messages

- 3,139

- Location

- Charlotte, NC

- Cars in Garage

- 1

- Vehicle Details

- '95 Thunderbird with '18 TF 5.3L - SVO Engine

Thanks for your input Ron!

And while I acknowledge that you're not an expert and these are just your opinions, I feel your opinions are pretty good! I guess now I just have to decide what to buy.

Between all the above after your input, I have narrowed it down to SCHH, F, and T.

SCHH: Allows me to get back into REITs and with federal interest rates recently going down and expected to go further down by EOY, I would expect this to tick up some more.

F: My dollar cost average is $7.50-ish (without logging into my account, I know it's in this range). It would bring up my DCA if buying more, but I like it's dividend return.

T: I should have bought more when it was at it's lows, but I wasn't in a position to buy at the time. With it's current share price where it's at, I've just about broken even right now. I'm just in it for the divvy's.

RYLD: It's not on my list after your opinions input, but if I were to buy more, it'd just be a yield trap for me. But it's low price right now is really enticing. -_-

Decisions, decisions.

You're welcome and thanks so much for the kind words.

On RYLD: Yes the price is low but you can't just look at a low price, you have to look at the big picture and always consider other options. Which direction is that price likely to go? Up, down or sideways? What catalysts will move the price? Are there better places to put your money? RYLD has only returned 3.1% since inception. I believe there are many better places to put your money. Why did you buy it initially? Has your thesis changed? If so it might be time to get rid of it, not buy more.

SCHH has low fees which is good. Looking more closely I see that it's an REIT Index fund. I believe your faith that interest rates will drop further before EOY driving the fund price up is misplaced and that the anticipated move upward has already occurred given the fund is already up 30.79% on the year. (The rate move is already baked into the price.)

I do believe there are way better dividend opportunities out there than F (A dying auto mfg.) or T (A dying telecom with a shit ton of debt.)

Having said that, T does currently have a buy rating on it with a 5% dividend yield. Personally, I recently sold my T for a small loss at 20.40. I've been holding it since 2018 and am happy to be rid of this white elephant to redeploy the funds elsewhere. I'm glad to read you're at break even on T now; that's a good place to be. T has their next earnings report on 23 October. I'd wait to see what the stock does after earnings before making a buy decision. In other T news, T has worked out a deal to dump their remaining 70% interest in DirecTV, which is a white elephant off of their necks too. At&T has done a good job reducing it's debt although it has a ways to go. Fundamentally, VZ is a better buy than T at this point. I'd look for a VZ buy at around $39.

F OTOH has a 5.4% Yield.

I do follow an individual analyst over at Seeking Alpha who tracks REIT's and I have great faith in, his name is Rida Morwa. I'd recommend buying individual REIT's over a fund of them.

Rida Morwa

Read thorough research and investment insights by Rida Morwa on Seeking Alpha here. View their credentials, investment style, areas of focus, and more.

CDsDontBurn

PostWhore

My attraction to ETFs now is for overall exposure to different individual companies and / or exposure to an industry at wide. REITs I know are cyclical and right now the market is at a low point because of the higher interests rates.

That said, SCHH holds a good chunk in AMT. I cannot buy AMT right now on an individual basis at the entry quantity point I want with their $223/share price right now.

RYLD seems to be fairly spread out across industries. While I feel it's currently a yield trap, maybe it could also be an opportunity to DCA down and get better yields? IDK.

I'm a bit undecided on what to get

.

.

My goal is to have dividends paying out and averaging between 5% - 7% across all my holdings.

That said, SCHH holds a good chunk in AMT. I cannot buy AMT right now on an individual basis at the entry quantity point I want with their $223/share price right now.

RYLD seems to be fairly spread out across industries. While I feel it's currently a yield trap, maybe it could also be an opportunity to DCA down and get better yields? IDK.

I'm a bit undecided on what to get

My goal is to have dividends paying out and averaging between 5% - 7% across all my holdings.

- Joined

- Sep 12, 2023

- Messages

- 3,139

- Location

- Charlotte, NC

- Cars in Garage

- 1

- Vehicle Details

- '95 Thunderbird with '18 TF 5.3L - SVO Engine

iffy stock but Gevo finally picked up momentum. I don't understand why people are so dramatic about intel. Even if they can't keep up, we need what they can make

- Joined

- Sep 22, 2023

- Messages

- 1,670

- Location

- Tennessee

- Vehicle Details

- Chameleon 1995 Thunderbird LX 4.6

- Joined

- Sep 12, 2023

- Messages

- 3,139

- Location

- Charlotte, NC

- Cars in Garage

- 1

- Vehicle Details

- '95 Thunderbird with '18 TF 5.3L - SVO Engine

The shares or the product?

Yeah, I should've been more specific. Let me try again.

Yeah, I should've been more specific. Let me try again.I bought some Hims and Hers Health Inc. (HIMS) stock yesterday.

- Joined

- Sep 12, 2023

- Messages

- 3,139

- Location

- Charlotte, NC

- Cars in Garage

- 1

- Vehicle Details

- '95 Thunderbird with '18 TF 5.3L - SVO Engine

Bought some AMD on Friday. What are you guys up to recently?

CDsDontBurn

PostWhore

Doubled down on F a couple weeks ago. Grew my position in F by 15-ish%